Looking for the latest topic on NGPF Data Crunch Answers? If YES, no look further, check out below for the revised key answers you are looking for.

NOTE: All key answers to NGPF Data Crunch are checked twice before publishing them to you. So, please do share as well if it helps you.

Also, check NGPF Taxes answers if you are looking for that particular part.

Table of Contents

NGPF Data Crunch Answer Key

Below you can find many solved NGPF Data Crunch answers for different topics:

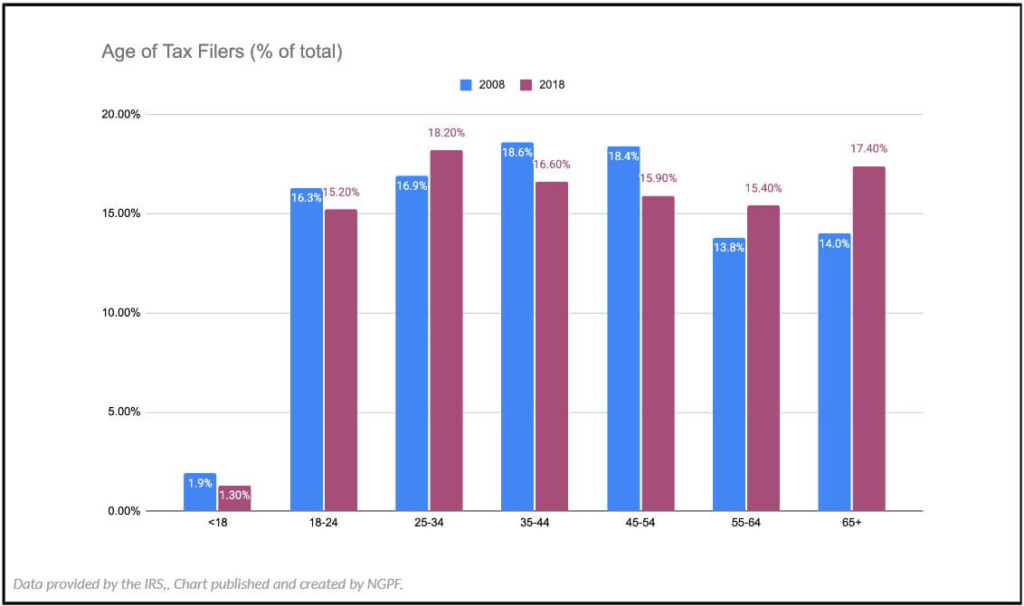

#Topic 1 – Age of Tax Filers

Q. Which age group represents the highest percentage of taxpayers in 2018?

Ans: 25-34

Q. Which two age groups have seen the sharpest increase as a percentage of taxpayers from 2008 to 2018?

Ans: 25-34 and 65+

Q. Why do you think the percentage of tax filers has most dramatically increased for the 65+ age group?

Ans: More older people are working and having to pay tax dollars.

Q. What do you think causes the percent of filers to jump so dramatically between the under-18 group and the 18-24 group?

Ans: After finishing high school, youth are more likely to obtain a full-time job and pay tax dollars because of it.

Q. What might have to happen in the U.S. for any dramatic changes to occur in future versions of this graph?

Ans: A vast population increase would result in more tax dollars being paid and a dramatic change.

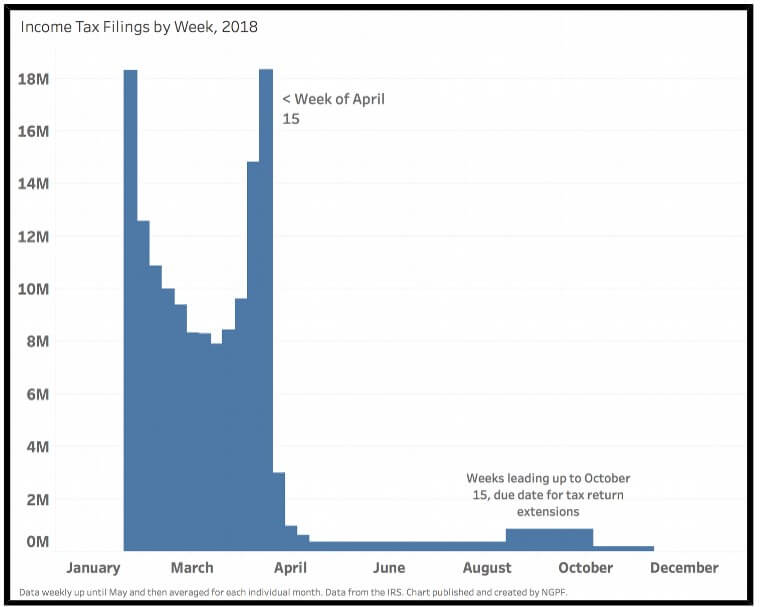

#Topic 2 – When Do People File Their Tax Returns?

Q. During what months do most people file their taxes?

Ans: February-April

Q. Approximately how many people filed their returns the first week of February and the week of April 15, combined?

Ans: 36 million people

Q. Why do you think no one filed their taxes in the month of January?

Ans: They had to wait to get their W-2

Q. Formulate an equation that would allow you to calculate the PERCENTAGE of people who filed their taxes during the week of April 15th.

Ans: You recently saw a news article that included this graph and had the title ” A Nation of Procrastinators ” . What evidence from the graph supports this title? A lot of people filed their taxes on April 15 which is when taxes are due. Most people either get things done early or procrastinate until they need to do it.

Q. You recently saw a news article that included this graph and had the title “A Nation of Procrastinators”. What evidence from the graph supports this title?

Ans: A lot of people waited until April to file and all the way to the last day to file their taxes.

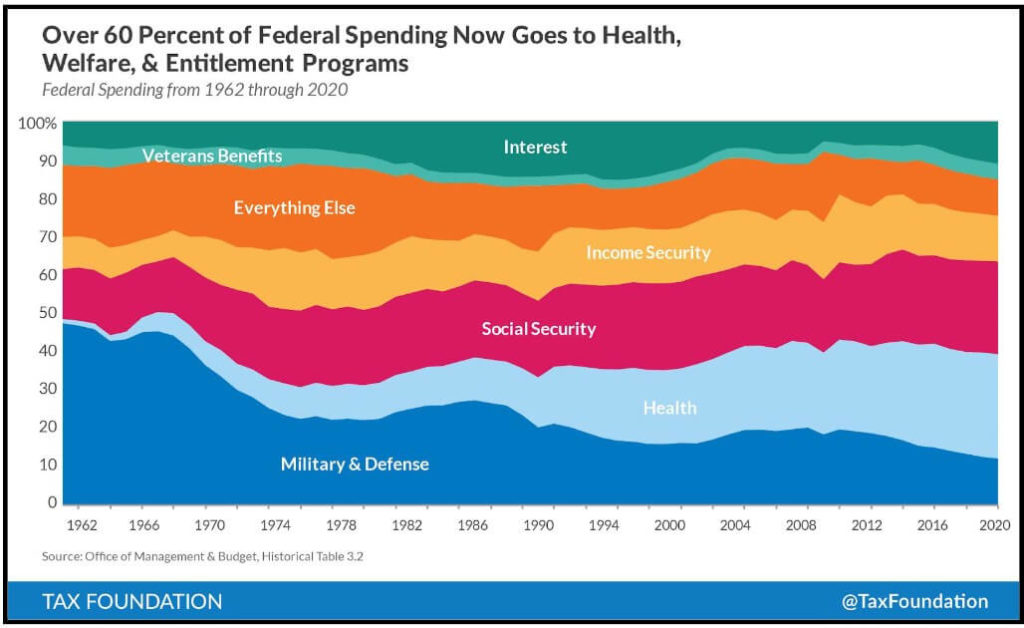

#Topic 3 – Where Do Our Tax Dollars Go?

Q. In 2020, what percent of federal spending will go toward paying interest on US debts?

Ans: 90%

Q. Which spending category has decreased the most since 1962? Which has increased the most?

Ans: Military and Defense have decreased the most. Health has increased the most.

Q. Predict what percent of federal tax spending will go toward income security in 2024 and 2028.

Ans: In 2024 it will probably be 70% and for 2028 it will probably be 90%.

Q. In creating this graph, the Tax Foundation chose to label the x-axis in 4-year increments. Draw a conclusion for why the graph makers have chosen this scale.

Ans: This is because some of the years on there has been the biggest increase or decrease.

Q. While it’s frequently noted that the US spends a great deal of money on the military, that percent of the tax budget has, for the most part, steadily decreased. Hypothesize why that might be the case.

Ans: The thing that has steadily decreased is everything else this is because some people back then were in the need of certain things. Today we are in need of things still but not as much.

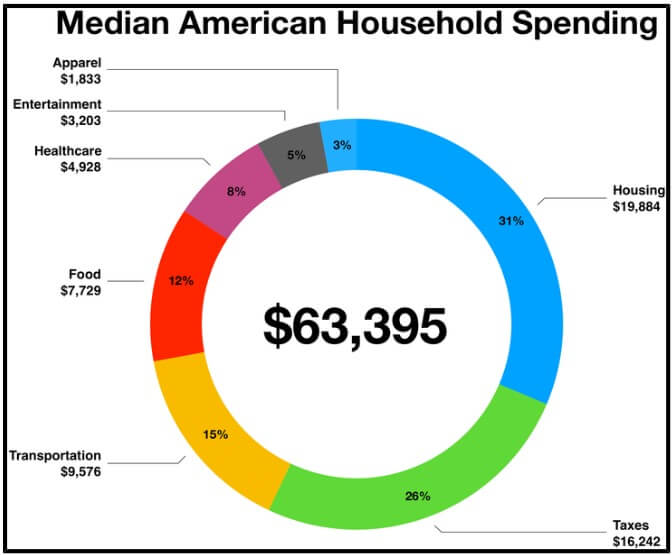

#Topic 4 – What Does The Average Household Spend Money On?

Q. Besides taxes, what are the three largest cost categories for families?

Ans: Housing, transportation, and food.

Q. How much more do families spend on transportation than on food?

Ans: Family spends $1,847 more on transportation than on food.

Q. What percentage of a typical family’s expenses would you consider needs as compared to wants?

Ans: 80% of typical expenses as needs as compared to wants.

Q. What expenses would you expect to stay the same month after month? Which would vary most month to month?

Ans: Housing, taxes, and healthcare I expect to stay the same month after month. Apparel, entertainment, food, transportation vary from month to month.

Q. You overhear a friend discuss how Americans are frivolous in their spending and waste lots of money. Use this data on family budgets to argue against his position.

Ans: Housing, taxes, and transportation which are all needs are the most paid for in American spending and the wants are the least paid for which proves that Americans do not necessarily waste money on wants because we need to spend on the needs first in order to have the wants and that leads to lots of spending such as housing and taxes.

#Topic 5 – What is the U.S. Savings Rate?

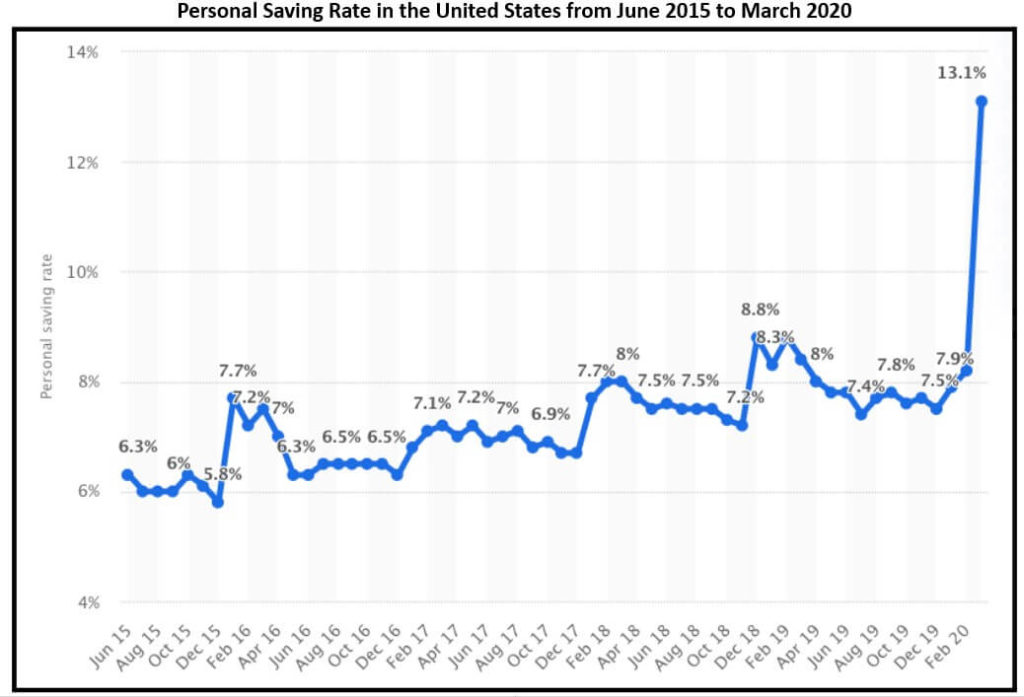

Q. Before March 2020, in what month and year did the US personal savings rate peak? What was the peak savings rate?

Ans: February 2020:13.1%

Q. In what month and year was the personal saving rate the LOWEST? What was the lowest rate?

Ans: December 2015: 5.8%

Q. How would you describe the overall savings trend in the U.S. from June 2015 to February 2020?

Ans: From December 2015 to February 2020 there was an incline in the overall savings trend, although there were a few drops it eventually reached a very high percentage.

Q. The savings rate increased every year at some point between Dec – Feb. Hypothesize why this might be.

Ans: It could be because the older generations started putting money away for their grandkids, or younger adults are getting into the habit of saving as the years go on.

Q. Since the start of the COVID global pandemic, the savings rate has jumped from 7.9% in February 2020 to 13.1% in March 2020. Why do you think this is?

Ans: Because people can’t leave their houses to shop and spend due to the lockdowns.

#Topic 6 – How Easy Is It To Get A Loan?

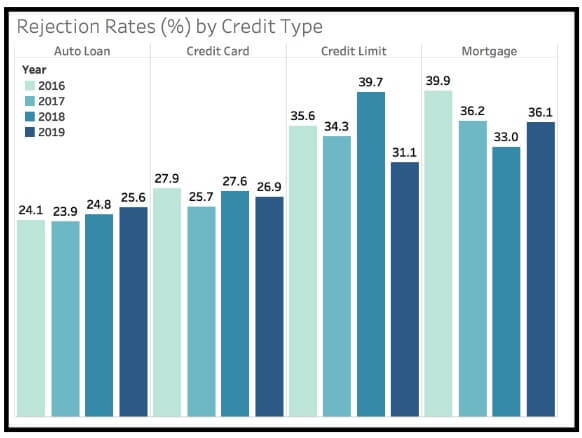

Q. Which option is more difficult to get: a credit card or a card limit increase?

Ans: Although a limit increase is preferable for people who already have a few credit cards, opening a new account might be a good idea if you have only one card. In fact, your credit scores will be enhanced by getting a second line of credit, despite the initial decrease that results from a hard credit inquiry.

Q. Was it easier or harder to get a mortgage in 2016 compared to 2019?

Ans: Getting a mortgage if you’re older may be harder since the Mortgage Market Review. Lenders expect you to pay off your mortgage by the time you retire, but some will consider extending past retirement.

Q. Which loan type had the most variability in their rejection rates from 2016 to 2019?

Ans: Mortgage

Q. Why do you think that auto loans have the lowest rejection rates among these credit types?

Ans: Auto loans are easier to get because it is something that can actually be repossessed. A physical item that can be taken away easier. Also, auto loans are considered a necessity

Q. You read a headline “Since 2016, consumers have had a much easier time getting loans of all types.” Agree or disagree with this headline using the data above.

Ans: Disagree

#Topic 7 – How Do Consumers Use Online and Mobile Banking?

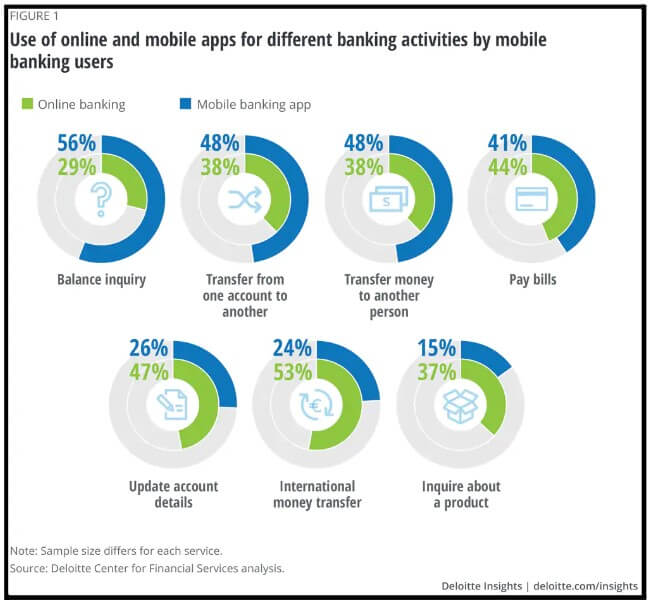

Q. What banking activity do most consumers use mobile banking for?

Ans: check account balances or recent transactions

Q. What banking activity do most consumers use online banking for?

Ans: transferring funds, paying bills, depositing funds, and updating account information.

Q. Look at the top 3 banking activities done via mobile banking vs. online banking. What characteristics do you notice for both?

Ans: The biggest difference between the two is their functionality. Online Banking allows you to conduct online transactions through your PC or laptop and an internet connection. On the other hand, mobile banking can be done with or without the internet. Many banks nowadays have their mobile apps for mobile banking.

Q. Hypothesize why nearly an equal number of consumers use mobile and online banking to pay bills.

Ans: It’s easier and more convenient for them, for example; they do not have to stand in long queues to pay through cheques.

Q. How do you think this data would look if it only looked at how GenZ uses mobile and online banking? Why?

Ans: I think the data would show that GenZ uses mobile and online banking more than older generations, this is because younger generations are more accustomed to it.

#Topic 8 – What’s The Relationship Between Education & Unemployment?

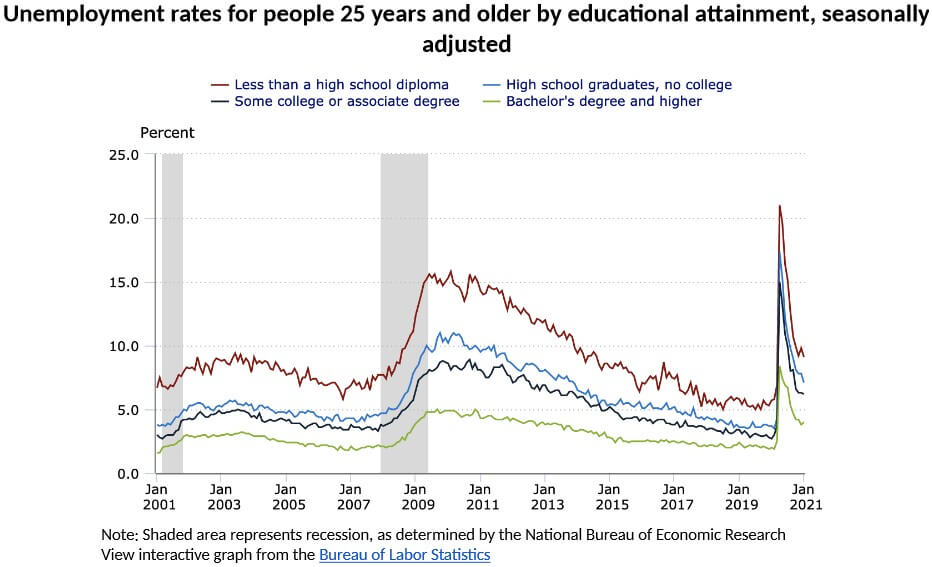

Q. Between January 2001 and January 2021, what was the peak unemployment rate for people with

college degrees? When did that occur?

Ans: The peak unemployment rate for people with college degrees occurred between 2019 and 2021.

Q. How many percentage points did unemployment increase for people with less than a high school diploma from January 2007 to January 2009?

Ans: unemployment increased for people with less than a high school diploma about 3.0 percent in January 2007 to January 2009.

Q. Which group had the least fluctuation in unemployment rates? Hint: Compare the peaks and troughs for each group.

Ans: The group with the least fluctuation in unemployment rates was the ones that had some college or associate degrees.

Q. News of the COVID-19 pandemic began to spread around the world in December 2019. Which group experienced the most significant changes in employment rates after COVID-19? Explain why you think this might be the case.

Ans: The group that experienced the most significant changes in employment after covid-19 was the people who are high school graduates, no college because companies are looking for more hires to fill in jobs they need to be done quickly.

Q. Which two groups (based on educational attainment) have the most similar outcomes when it comes to

rates of unemployment? Explain why you think this might be the case.

Ans: The two groups that have the most similar outcomes when it came to rates of unemployment are people who have a bachelors degrees and higher and the people who have some college or associate degree because they have so type of degree and that’s what most people look at when hiring and have studied some kind of career that is hard to have without a degree.

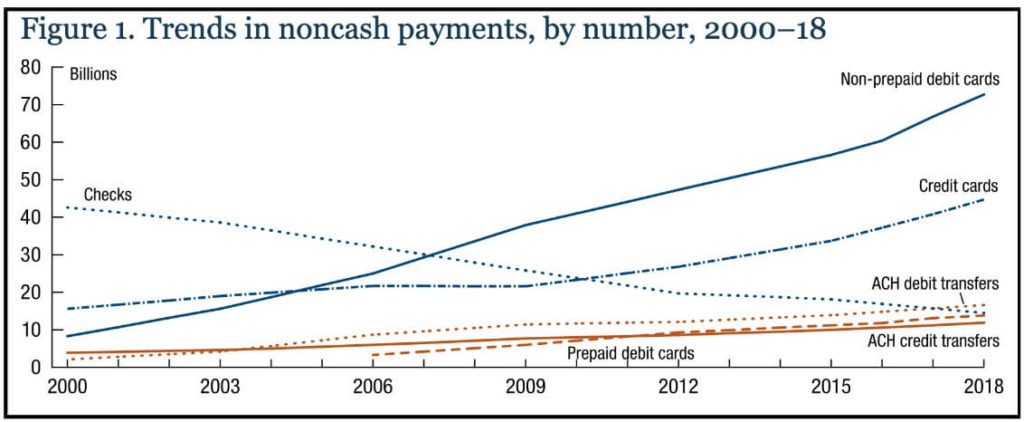

#Topic 9 – What Are The Trends in Non-Cash Payments?

Q. Which type of payment has increased the most since 2000?

Ans: non-prepaid debit cards

Q. How many billions of credit card transactions occurred in 2018?

Ans: Up to 80 billion

Q. Predict how many billions of non-prepaid card transactions will occur in 2020.

Ans: Around 95 billion

Q. In 2004, the number of credit card and debit card transactions was quite similar. By 2018, they had very different usage. What do you think caused the variance in growth?

Ans: A rise in online banking.

Q. Check transactions have decreased every year since 2000. Hypothesize what the graph for check transactions will look like by the year 2030.

Ans: Each year about 1 or 2 billion checks are not being used anymore so by the year 2030 about only 10 billion checks will be used by the public.

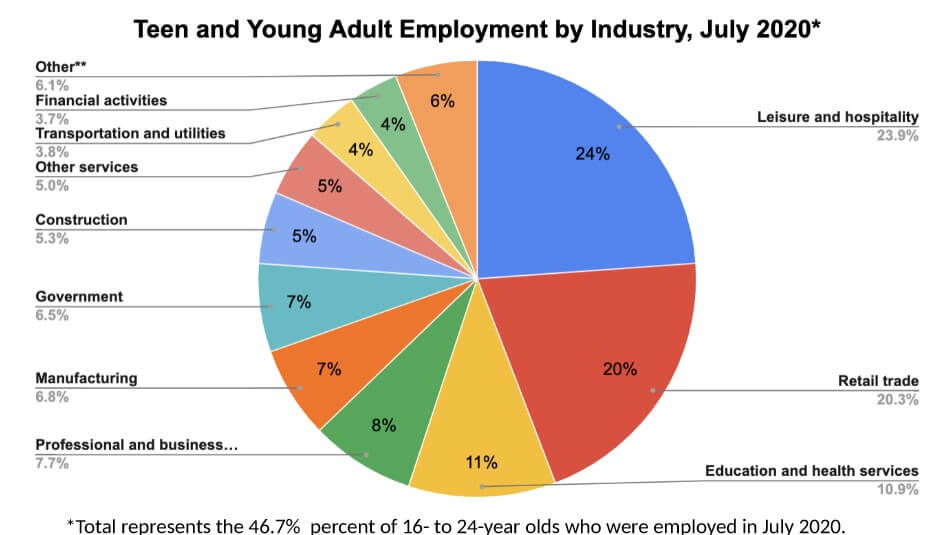

#Topic 10 – Where are Teens & Young Adults Working?

Q. What percent of 16- to 24-year-olds were employed at the time this data was collected?

Ans:46.7% percent of 16-to-24-year-olds were employed at the time this data was collected.

Q. What are the top three industries employing teens and young adults?

Ans: The top three industries employing teens and young adults are leisure and hospitality, retail trade, and education and health service.

Q. Categorize which industry each of the following jobs falls into:

Ans:

a. Cashier at Nike – retail trade

b. Server at a restaurant – other services

c. A worker at a plant that makes computer equipment – manufacturing

d. Teller at the local bank – government

Q. Look closely at the fine print for what’s included in the Other** category. What can you assume are the highest percentage of teens and young adults working in any one of the fields listed? Justify your response.

Ans: The highest percentage of teens and young adults working in any one of the fields listed in other** has to be about 2% percent because not many people have lucky and have a successful career or they don’t get many paining customers to keep their career going.

-> Browse other NGPF topics with answers

We hope you got the right NGPF data crunch answer key by simply following the above answers attached. Please share among your friends who might be looking for the same.

WPFaspe, the prolific author behind the enlightening works housed within Faspe, passionately contributes to the educational haven as a beacon for educators, parents, and students. With a resolute commitment to nurturing the unfolding journey of education, WPFaspe’s writing encapsulates a dedication to fostering growth, curiosity, and learning at every step, embodying the fundamental belief that education is a perpetual voyage rather than a mere destination.